Inflation - Fighting Yesterday's Battle

The call for a late day rally worked out a little, in that the market tried to come back in the last half hour, but still closed down a bit.

Volume rose on both exchanges, an unwelcome sign, and breadth was negative.

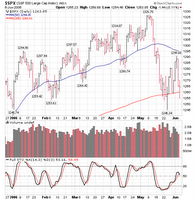

The SPX tested it's 200-day average for the 2nd time, but was able to close above this key level. (see chart above) GOOG had it's best day since it reported earnings in April. This is a good sign, as GOOG was able to buck today's weakness and may be a good leading indicator for the market.

With sentiment as negative as it is, one might wonder why the market hasn't rallied more. I would remind you that sentiment is a secondary indicator, with the primary indicator being the price and volume activity of the major indexes.

When we failed to get the strong follow-thru day I was looking for, it indicated that the market may have more work to do. Of course, I did not expect it to all come in one day, but the market seems overly sensitive to Bernanke's remarks about inflation.

I think that inflation has likely already peaked, so these fears are missplaced. This should become apparent as the year progresses, and should boost stocks at some point as well.

0 Comments:

Post a Comment

<< Home